Lease vs Loan: Don’t OVERPAY for Tesla Model Y or Model 3

***Updated February 17th, 2023***

If you're about to purchase a Tesla Model Y or Model 3 and think that leasing is the cheaper financing option, don’t let the low monthly payment fool you! Read on, and I will show you how leasing a Model Y or Model 3 might end up costing you up between $11K to over $19K or so more than financing with a traditional loan.

Special Note: Now, first off, I have to make it very clear that I'm not a tax professional nor a financial professional, and I do understand there are certain circumstances where leasing a vehicle does make sense. Many of those are business use cases or certain tax situations. So I understand that this will not apply to everyone. But I do believe what I'm talking about right now does apply to a lot of people. But as always, do your own research before making any major purchase like this. And if there are tax situations involved, make sure that you talk to a certified tax professional before making big decisions like this.

Now, on a surface level, leasing a Tesla looks very attractive. First of all, there is a lower monthly payment, so the actual money that you're paying for the vehicle that you see out of pocket every month is slightly less than a loan. Also, with a lease, you're able to constantly upgrade to the newest vehicle and every three years or so, depending on what the length of your lease is. However, you must be aware that this convenience comes at a cost over getting a traditional auto loan.

Lease and Loan Assumptions:

First of all, it's important that I point out the assumptions for this video. We're going to go with a 3 years lease with a mileage allowance of 30K miles (10K miles per year). This lease from Tesla requires a $4,500 down payment and Tesla charges a lease acquisition fee of $695 plus an order fee of $250. Also, for our calculations, we're going to assume that you turn in this vehicle back to Tesla at the end of those 3 years, as they don’t allow you to purchase the car when the lease term is over. For the loan side of the calculation, I'm also going to go with the terms that Tesla specifies on their website, a 72 month loan term financed at 5.44% interest rate with $4,500 down. We're going to assume that after 3 years, you're also going to sell the Model Y or Model 3 that you purchased. So with those assumptions, let's dive into the numbers.

Purchase and Finance Details:

If you go to Tesla's website right now, the LONG RANGE AWD variant of the Model Y starts at $54,990, and the performance version starts at $58,990. When it comes to the monthly payment comparisons, you can see that Tesla estimates that you can lease a Long Range AWD Model Y for around $629 per month, or $848 per month if you finance the vehicle with a traditional auto loan for 72 months at the 5.44% APR (with $4,500 down).

So, on a surface level, getting a loan for a Long Range AWD Model Y will end up costing you over $200 more per month. This is substantial, and may be the difference between being able to afford the vehicle or not, but this lower monthly lease payment may not be as good of a deal as it may seem.

The Numbers Don’t Lie

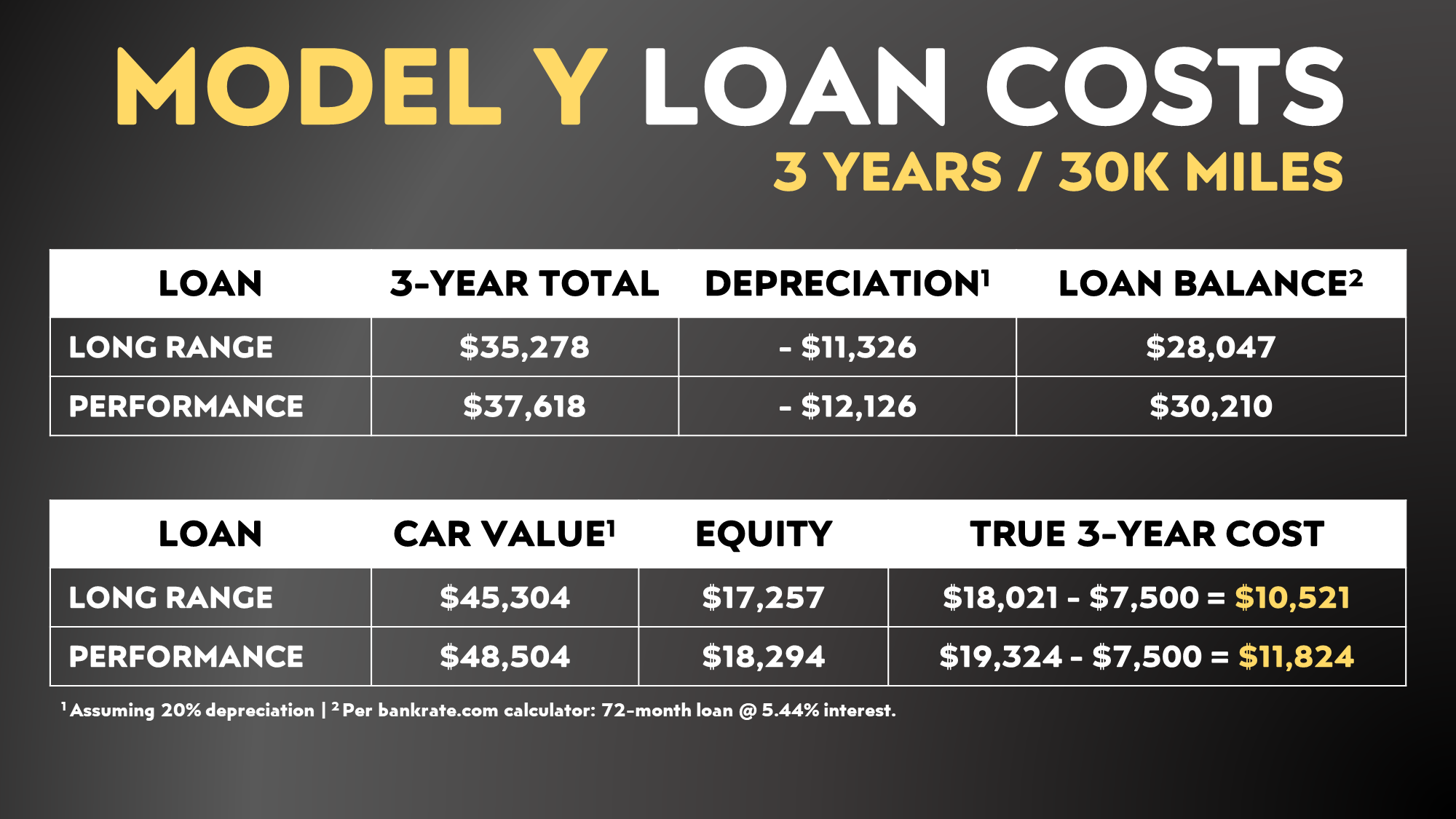

So, first of all, for our calculations, the cost of each of these vehicles needs to include the $1,390 destination and doc fee as well as the $250 order fee. In the chart below, I've added that fee to the cost column. Tesla’s finance calculations also factor in a $4,500 down payment, and you can see below the payment amounts for leasing or loan based on Tesla's calculations for teh Long Range and Performance variants.

In the final 3 year total column, you can see that I've added up the accumulation of 36 monthly payments for either leasing or for a loan, plus any applicable fees like the lease acquisition and order fees. This amount also includes the $4,500 down payment as well. So as you can see in that last column, there is over a $6,000 difference between a loan and a lease when it comes to upfront 3 year finance cost. for either version of the Model Y.

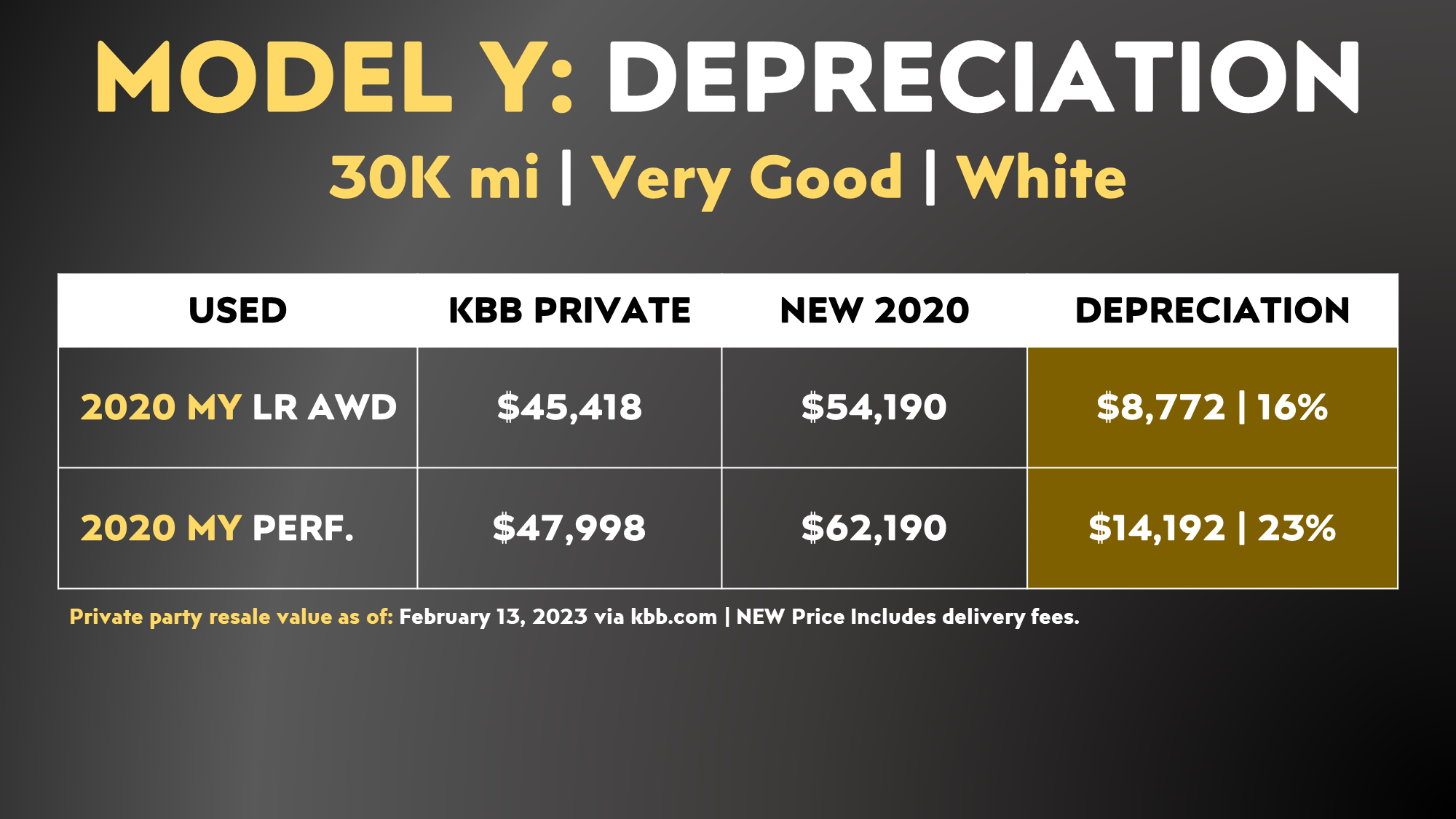

However, we need to also look at how much this vehicle depreciates, and its value after 3 years and 30K miles, because while vehicles are traditionally a depreciating asset, those that have strong resale values like the Tesla Model Y are likely going to be more expensive to lease in the long run. When it comes to estimating how much the Model Y will depreciate in 3 years and 30K miles, if you go to Kelley Blue Book and look at the value for a 2020 Long Range AWD Model Y with 30k miles in very good condition, as compared to it’s purchase price in 2020, that vehicle has lost around 16% of it’s value. In addition, the performance version has lost around 23% of it’s value.

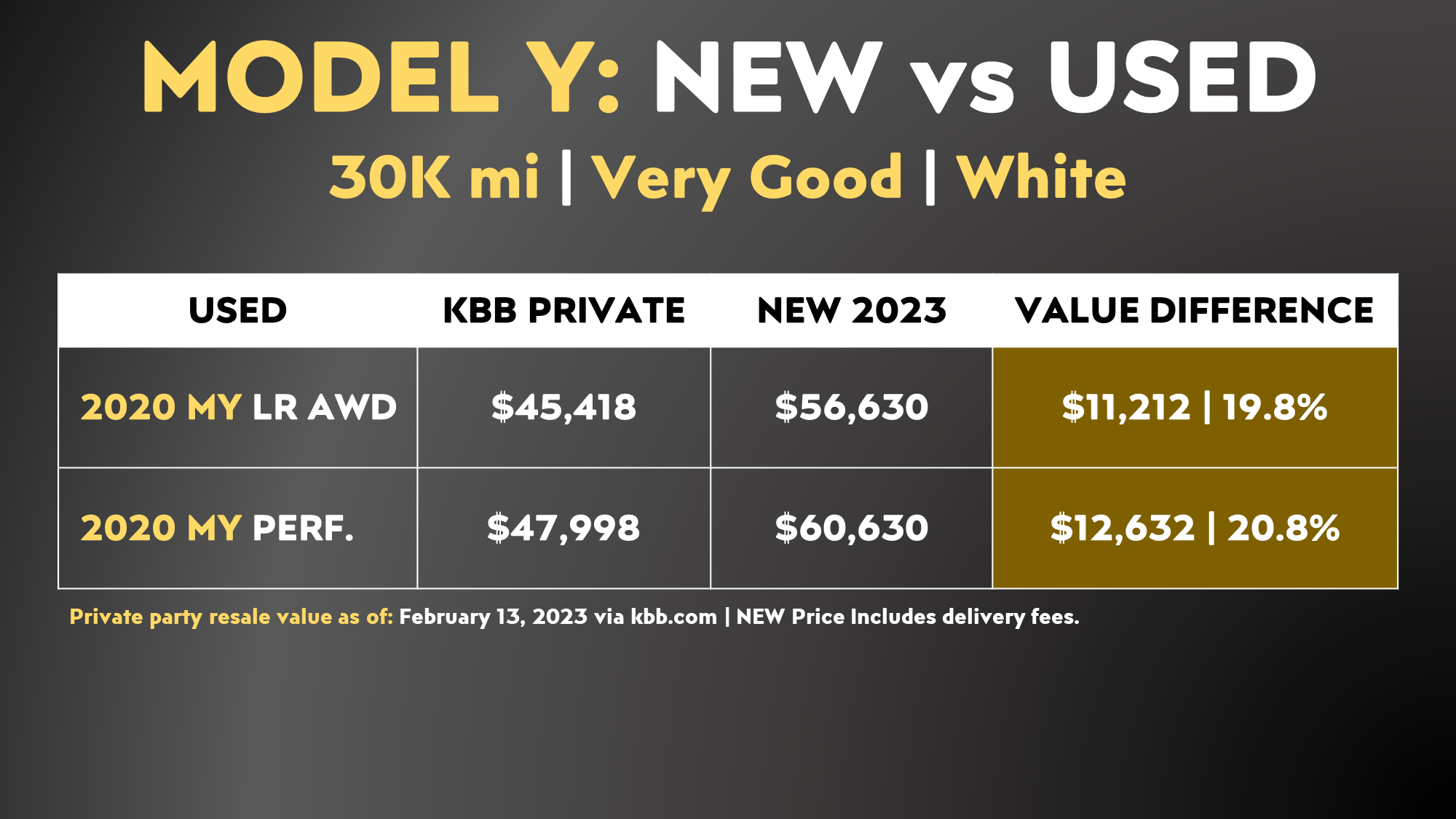

However, since Tesla is constantly adjusting their prices, I believe it will actually be more accurate to compare the price back in 2020 to what the same vehicle cost new in 2023, and use that amount for our estimates. So, as you can see in the chart below, a depreciation estimate around 20% will actually be more appropriate and will likely be more in line with what the Model Y is worth 3 years from now.

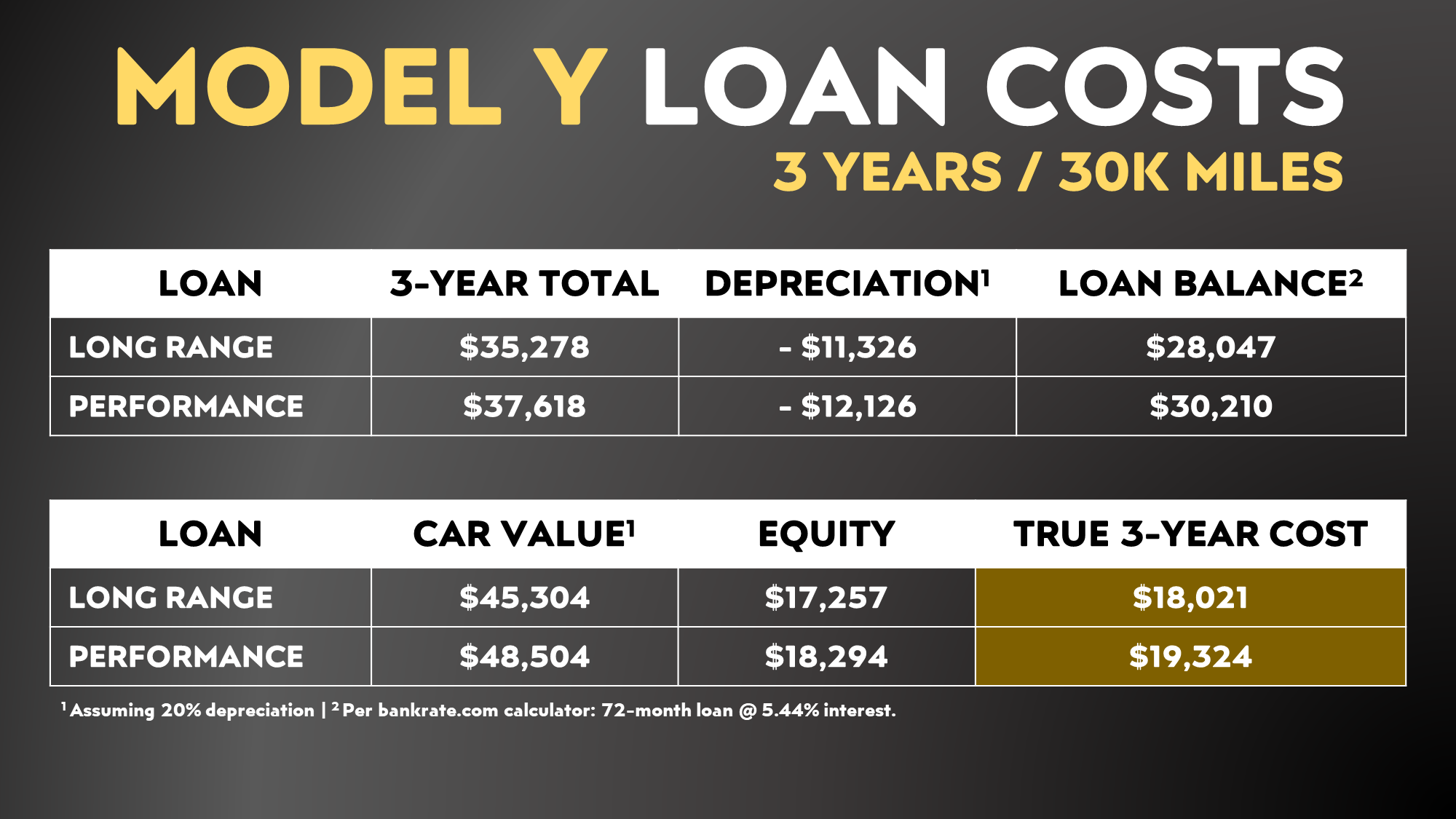

Now, we need to calculate the loan balance amount halfway through that 72 month loan, and use our estimated 20% depreciation to determine how much the vehicle will be worth in 3 years. Using those numbers, if you subtract the loan balance amounts from the car value, you are actually left with over $17K equity due to the strong resale value. If you subtract this equity amount from the 3-year finance total that we calculated earlier, you are left with a true 3-year loan finance cost for the Long Range AWD Model Y of a bit over $18k, and the Performance version a bit over $19k.

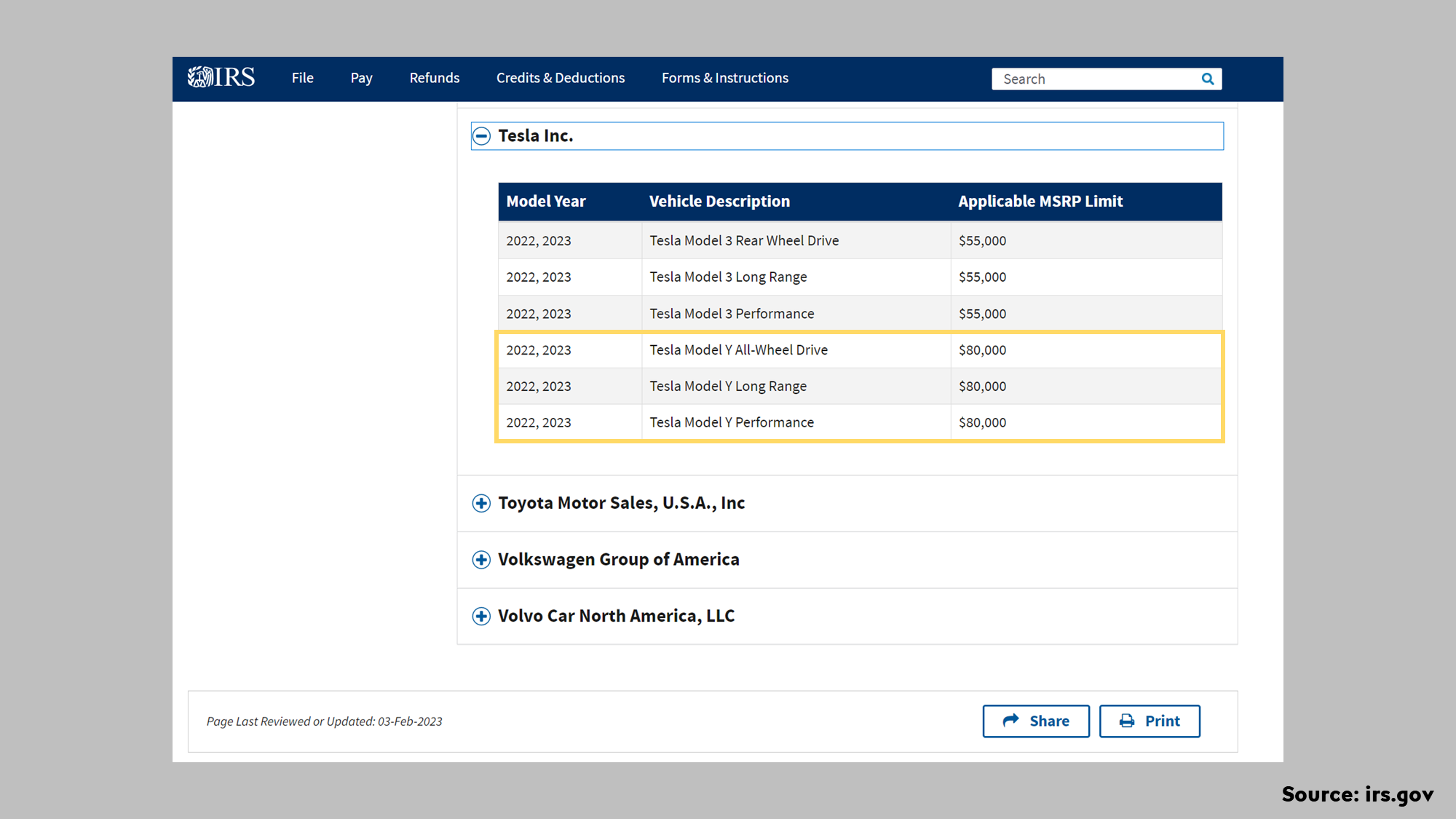

But, we need to actually factor in the $7,500 federal tax credit that the Model Y qualifies for, and subtract that amount from our 3 year cost calculations. You can read more about who qualifies for these tax credits here, but assuming your income is not above the cap, this is a big incentive. As far as I understand, this tax credit does not apply to leasing a vehicle.

So, for those who qualify for the full $7,500 tax credit, this actually lowers the true 3-year finance cost substantially to around $10,521 for the Long Range AWD Model Y, and $11,824 for the Performance version.

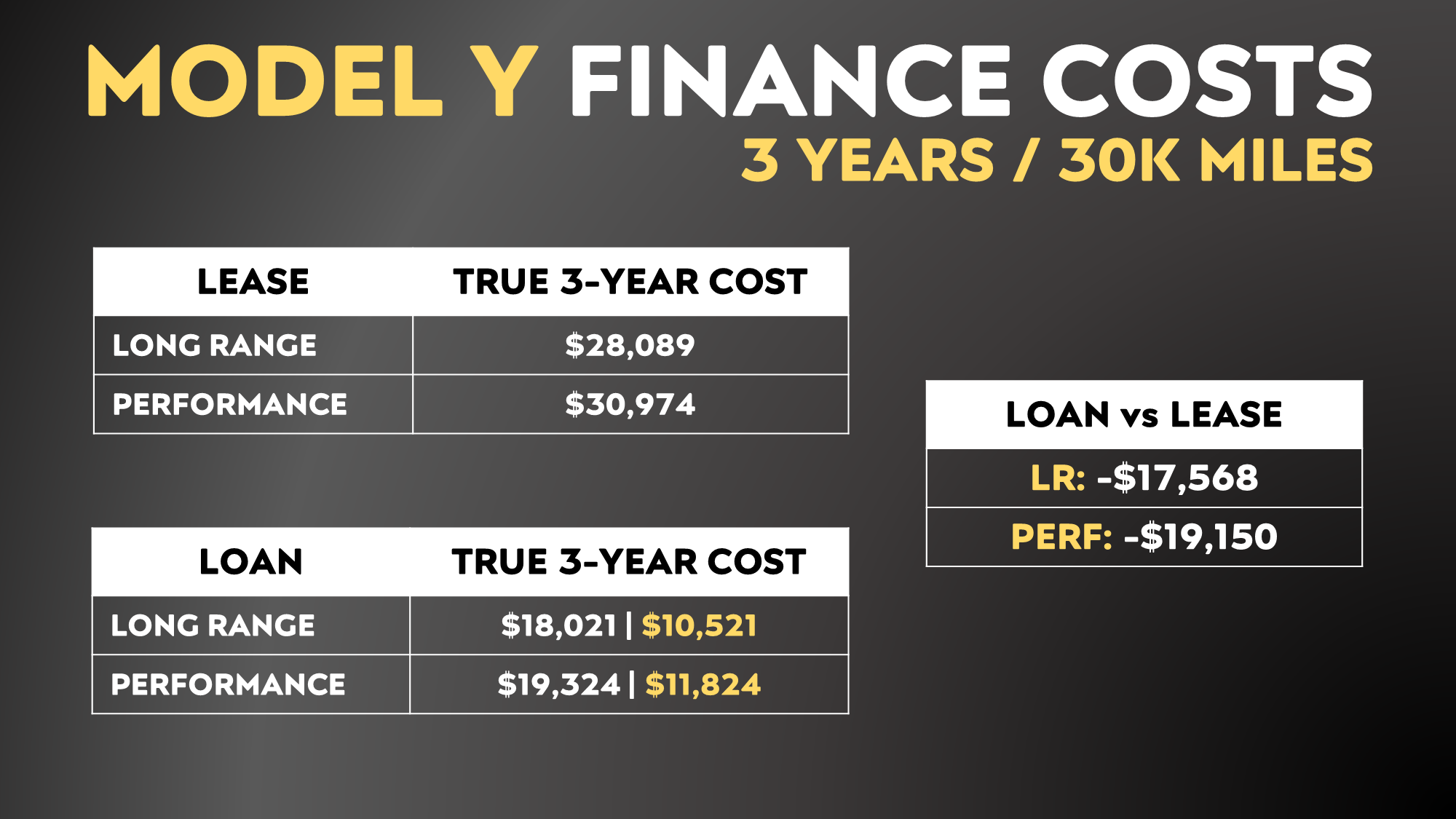

When you put these estimated loan costs side by side to the true cost of leasing, if you consider the value of the Model Y after 3 years in those calculations (which you don’t benefit from with a lease), you can see that getting a loan on a Model Y and selling it after 3 years could potentially save you over $17K or $19K over a lease if you qualify for the full $7,500 tax credit. Now, I don't know about you, but that's a lot of extra cost for the convenience of a lease, and this shows that with a vehicle like the Model Y, that is holding its value very well, leasing may not be the best option.

What about the Model 3?

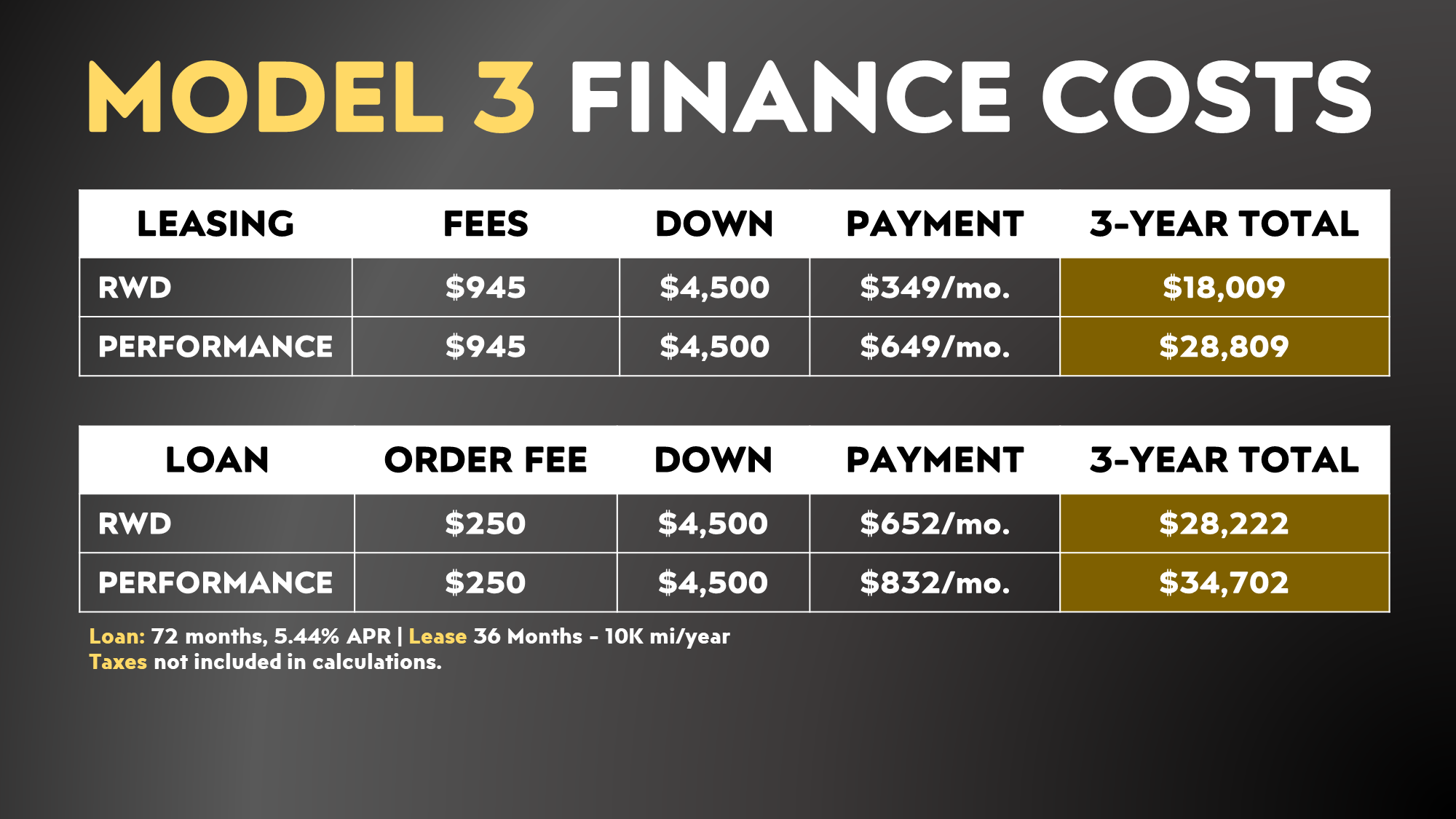

When it comes to the Model 3, Tesla is currently offering a very attractive 3 Year/30k lease for $349 per month, which is a bit over $300 than their estimated monthly payment if you financed this vehicle with a traditional 6 year loan. In our preliminary 3 year finance total, you can see that once again, leasing appears to be the smarter financial decision, however, once again we need to factor in resale value after 3 years to get the real story.

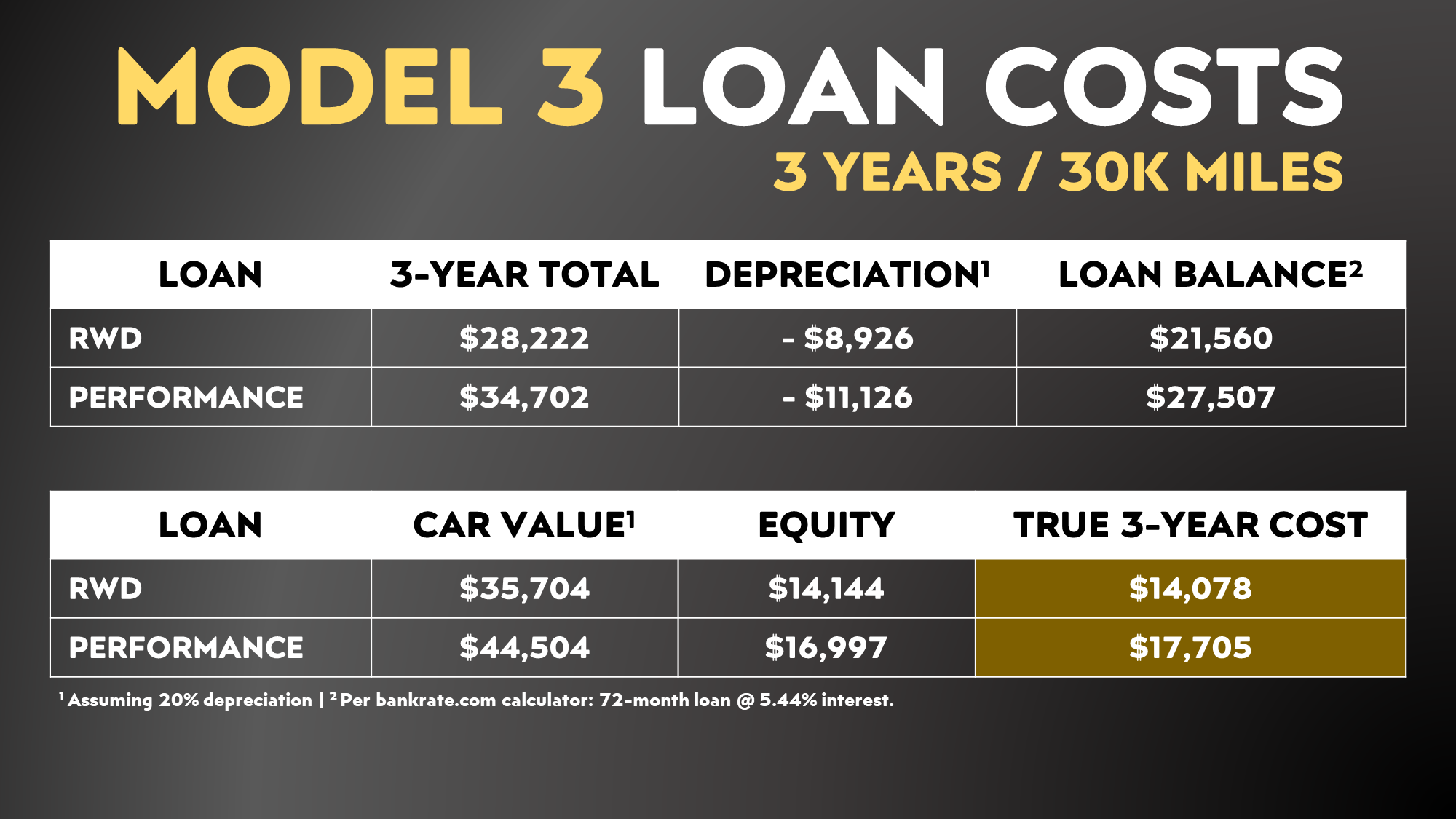

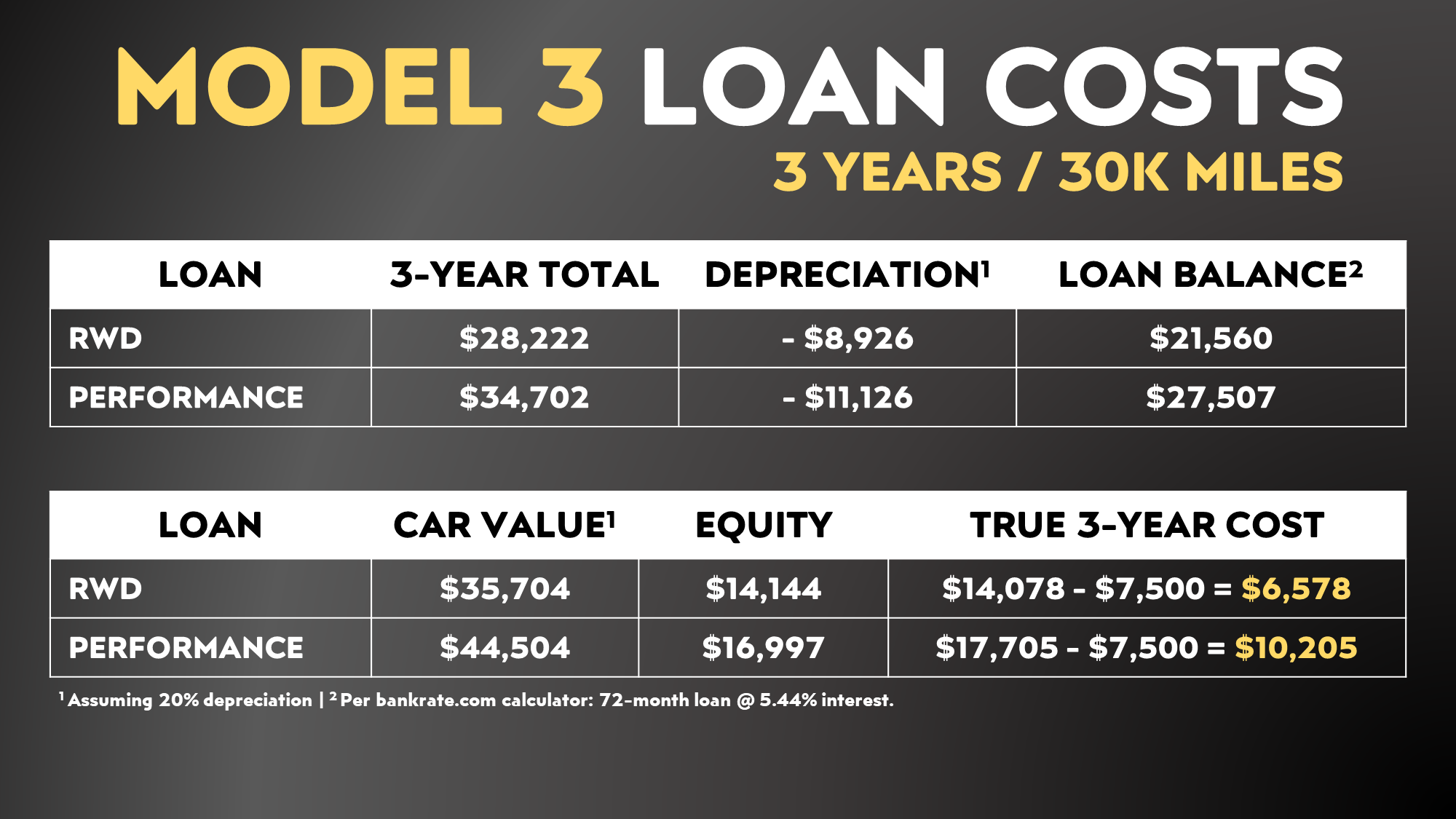

Based on my research using data from Kelly Blue Book, I am going to once again assume that the Model 3 will generally depreciate around 20% after 3 years and 30k miles. Once again, we need to calculate the loan balance amount halfway through that 72 month loan, and use our estimated 20% depreciation to determine how much the vehicle will be worth in 3 years. Using those numbers, if you subtract the loan balance amounts from the car value, you are actually left with a substantial amount of equity due to the strong resale value. If you subtract this equity amount from the 3-year finance total that we calculated earlier, you are left with a true 3-year loan finance cost for the RWD Model 3 of $14,078, and the Long Range version $17,705.

However, the Model 3 also qualified for the $7,500 tax credit in the USA, so we need to factor this in as well. Do note, that in March the IRS will issue guidance regarding the sourcing of battery materials which may end up disqualifying the RWD Model 3 since it currently uses LFP batteries sourced from CATL in China, but for now it qualifies according to the IRS.

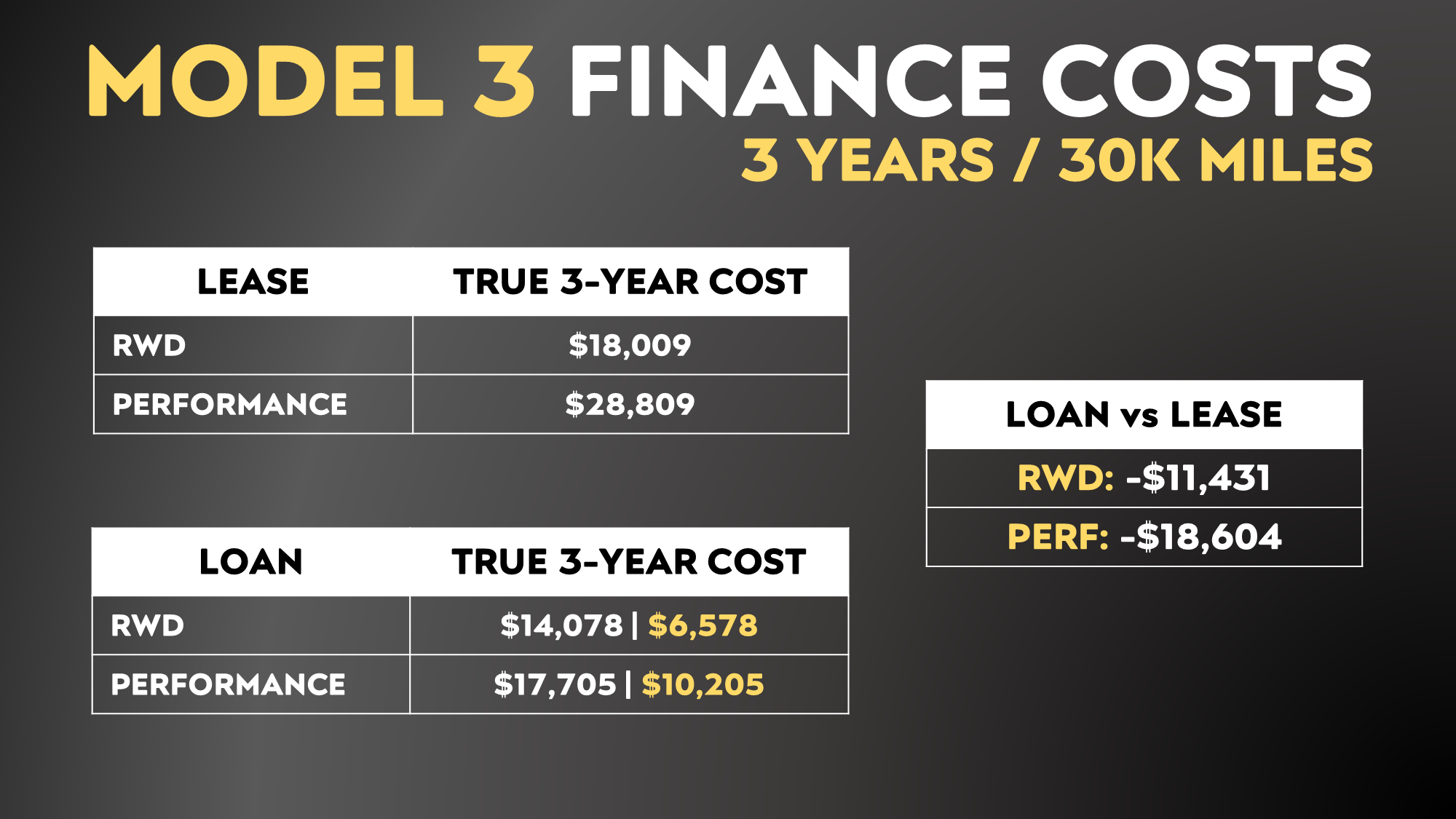

So, for those who qualify for the full $7,500 tax credit, this actually lowers the true 3-year finance cost substantially to around $6,578 for the RWD Model 3, or $10,205 for the Long Range version.

So, when you do the final calculations like we just did, with the tax credit subtracted, leasing a Tesla Model 3 may end up costing you somewhere between $11K and $18K or so more, than getting a loan for that same vehicle.

What about higher depreciation and other factors?

Now, there are a number of factors that could change my calculations like, if you traded in your vehicle instead of selling it yourself. However, if you don't agree with my depreciation percentages and you think that the depreciation of Tesla's Model Y or Model 3 will be much greater in three years, I did some math and found that with the exception of the RWD Model 3, these vehicles would have to lose somewhere around 40% to 50% of their value in 3 years for the cost of leasing to match the cost of a loan. I could be wrong, but I don't foresee the Model Y being worth 40% to 50% less after 3 years and 30K miles.

So, if you believe that the Tesla Model Y and the Model 3 are going to hold their value very well into the future, then it sure appears like you'll be better off getting a loan versus getting a lease. Leasing a vehicle still may make sense for some situations, so I encourage you to do these calculations for your specific use case. However, I believe leasing a Tesla Model Y or Model 3 will be more expensive than a getting a loan for most people.

Other recent articles: